-

Meet Loylogic at Loyalty & Awards 2025 in Amsterdam

Loylogic is proud to be participating in Loyalty & Awards 2025, the annual conference organised by Global Flight that brings together loyalty leaders from across airlines, hotels, banks, booking platforms and technology providers. Taking place in Amsterdam from 20 to 22 October, the event is recognised as one of the most important gatherings for professionals shaping the future of customer loyalty and rewards.

Our team – Martin Smaerup, Rahul Mukkath and Gabi Kool – will be in attendance and available to discuss loyalty strategies, emerging technologies and new opportunities for collaboration.

Alongside the many opportunities to connect with peers, we are delighted to contribute to the official programme. Gabi will be joined on stage by Dr. Nceba Hene (PhD), Head of Loyalty and Rewards at African Bank, for an in-depth conversation about the challenges of building and optimising loyalty programmes in lower income markets. Their discussion will highlight how African Bank’s award-winning Audacious Rewards programme has balanced financial inclusion with meaningful customer engagement, while also providing broader insights into Africa’s fast-changing payment, rewards and loyalty landscape.

The wider conference agenda offers a rich mix of keynote sessions, expert panels and case studies covering loyalty innovation across sectors. Topics range from the use of artificial intelligence and digital platforms to enhance customer experience, to the role of partnerships in expanding programme value. Delegates will also hear from industry leaders on measuring performance and ROI, and gain inspiration from the winners of the Golden Loyalty Awards, which recognise excellence and innovation across the industry. Networking events, including one-to-one meetings and social gatherings, provide further opportunities to exchange ideas and forge new partnerships.

For those attending, the Loylogic team would be delighted to arrange meetings during the conference. Please feel free to contact us via our website to set up a time.

Loyalty & Awards 2025 takes place in Amsterdam from 20 to 22 October at the Mövenpick Hotel Amsterdam City Centre. Registration is now open and more information can be found on the official website.

-

Loylogic Highlights Transformative Power of Gratitude at HR World Summit 2025

Loylogic made a compelling impression at the 2025 HR World Summit recently, presenting evidence that one simple practice can have a profound impact on workplace performance.

In a session led by leadership and performance management innovator, Tamra Chandler, and Loylogic’s CEO, Gabi Kool, attendees explored how strategic gratitude is more than a feel-good initiative. It is a business-critical strategy that drives measurable improvements in employee engagement, productivity, and profitability.

The session, titled 100 Moments that Matter, showcased research-backed insights demonstrating that regular, intentional recognition reduces staff turnover by up to 31 per cent and can boost team performance by 50 per cent. Attendees learned how to translate these insights into actionable strategies through Loylogic’s Ultimate rewards and recognition program – click here to find out more – by building a compelling business case for recognition that resonates with even the most sceptical executives.

Tamra and Gabi highlighted the “triple impact” of gratitude on wellness, performance, and organisational success. Tamra explained, “It’s not just about making people feel good, it’s about measurable results for the business. Recognition drives engagement, productivity, and innovation.”

The session emphasised that recognising employees at key moments throughout the year directly affects business outcomes. As Gabi stated, “When you acknowledge someone at the right time, the impact goes beyond that moment. It strengthens relationships, motivates performance, and creates a culture that sustains itself.”

A central feature of the session was the Ultimate 100 Moments that Matter framework, designed to integrate gratitude into everyday workplace interactions. According to Tamra, “These are the moments that might seem small, but collectively they shape how people feel about their work, their team, and the organisation.”

Loylogic’s session also offered practical advice for HR leaders and executives looking to implement recognition strategies. By demonstrating a clear link between gratitude and performance metrics, the session provided attendees with tools to justify investment in employee recognition programmes and embed appreciation into organisational culture.

The HR World Summit audience, comprising senior HR leaders and business decision-makers from across Europe, responded enthusiastically. Many noted that the session offered actionable insights that could be implemented immediately, providing both strategic and operational value.

As organisations navigate increasingly complex workplace environments, the evidence presented offers a clear message: investing in employee recognition is an investment in organisational performance, resilience, and long-term growth.

Gabi concluded, “It’s about creating a sustainable culture of appreciation. When you do that, you elevate performance across the board, and that’s what every business leader should be aiming for.”

-------------

Ready to transform your workplace culture and performance? Discover how Loylogic’s Ultimate Employee Motivation Solution leverages the 100 Moments that Matter to reduce turnover, boost productivity and create lasting engagement. Book a demo today and see how strategic recognition can drive measurable results for your people and your business.

-

Restoring The Lost Art Of Giving: Why Emotional Value Is The Future Of Loyalty

A recent episode of the Loylogic Podcast brought together founder Dominic Hofer and CEO Gabi Kool to explore how loyalty programs can move beyond transactions and bring back something that’s been missing for years: emotional connection. They call it the Art of Giving. At the heart of the conversation is a belief that loyalty should mean more to a brand’s best customers, the brands themselves and to the partners that connect them. Here are the key takeaways from their discussion.

1. Loyalty should mean something Dominic and Gabi are both clear that the future of loyalty is emotional, not transactional. For too long, loyalty programs have focused on currencies and redemptions. Loylogic’s view is that the real power lies in creating meaningful moments that reward people in ways they truly value. In the podcast they explain that bringing back this ‘lost art of giving’ is something Loylogic is determined to revive.

2. Loyalty needs long-term thinking Customers want more than short-term perks. Brands want more than temporary engagement spikes. That’s why the focus now is on loyalty strategies that deliver long-term value on both sides. Rewards should not just be useful. They should be memorable and motivating too.

3. Personalization must scale without complexity Today’s consumers expect personalization. But it has to be done at scale and in real time. That means using AI and data intelligently, understanding preferences faster and delivering smarter recommendations. The episode explores how Loylogic is helping partners build loyalty programs that feel more personal without becoming more complicated.

4. The marketplace must be smarter The rewards marketplace has evolved. It’s no longer about fixed catalogs or generic offerings. Loylogic is building the world’s smartest, most flexible rewards marketplace powered by AI, driven by data and designed for constant optimization. It’s about offering the right reward at the right time through the right partner in the right market.

5. Partnerships are the foundation One of the strongest messages in the episode is that long-term success depends on trust. Loylogic is focused on building sustainable partnerships with both brands and merchants. It’s not about one-off campaigns. It’s about shared goals, transparent collaboration and creating a network that benefits everyone involved.

6. Innovation should always serve the customer Technology plays a huge role in the future of loyalty, but it’s not about tech for tech’s sake. As Dominic and Gabi make clear, the goal is to use innovation to make the customer experience feel more human, not less. That means designing rewards ecosystems that are intuitive, inspiring and built around people, not just platforms.

7. The next 20 years start now Loylogic’s first 20 years have been about building and proving the power of reward solutions, designing some of the world’s leading reward programs. The next chapter will be about leading the industry forward, taking this success to the next level, and driving transformational loyalty.

________________________________________

Ready to rediscover the art of giving?

If your loyalty program is feeling transactional, we’d love to help you bring the emotion back. From smarter marketplaces to more meaningful rewards, Loylogic gives you the tools to reconnect with what loyalty is really about. Let’s talk about how to build a loyalty experience that delivers emotional depth and strategic value.

________________________________________

Listen to the full episode: Celebrating 20 Years of Loylogic — What’s Next? is available now on Spotify and Apple Podcasts. Or listen below:

-

Pulse iD and Loylogic Partner to Deliver Smarter Loyalty Engagement

Pulse iD and Loylogic have announced a strategic partnership to reshape how banks, fintechs, and merchants drive customer engagement through loyalty.

By bringing together Pulse iD’s AI-powered personalization and real-time engagement technology with Loylogic’s global reward experiences and marketplace infrastructure, the collaboration creates a next-generation loyalty offering built for the digital-first consumer.

Pulse iD enables real-time, context-aware interactions through card-linked offers, location-based triggers, and behavioral AI. Loylogic complements this with deep capabilities in loyalty commerce, including merchant-funded rewards, global fulfillment, and access to a diverse catalog of over 10 million rewards, ranging from merchandise and gift cards to experiences and travel.

“This partnership allows us to combine our engagement technology with a rich global reward inventory,” said Rashindu, Co-founder and Chief Product Officer of Pulse iD. “Together, we’re enabling loyalty programs to move from retrospective rewards to intelligent, real-time engagement that’s both personalized and instantly actionable.”

“With Pulse iD’s real-time capabilities and Loylogic’s reach across 50 million+ loyalty consumers, we’re creating a smarter way to engage,” said Gabi Kool, CEO of Loylogic. “Our strengths in sourcing, fulfillment, and Loyalty-as-a-Media™ ensure that offers are not only hyper-relevant, but also discoverable, scalable, and rewarding for both brands and consumers.”

The combined solution unlocks new revenue and engagement opportunities for financial institutions and merchants by offering:

- AI-driven personalization and behavioral targeting

- Card-linked, real-time offers embedded in customer journeys

- Curated, merchant-funded deals across global and local markets

- Expanded brand exposure via mobile apps, loyalty shops, inflight experiences, and more

Announced during Seamless ME 2025, this collaboration reflects a shared vision to evolve loyalty from points-based transactions to real-time, data-powered experiences that deliver measurable value and long-term customer retention.

-

New Loylogic ebook addresses how to bring back the art of giving in loyalty

The best loyalty programs today are thinking beyond transactions. They’re creating emotional connections, building brand affinity, and delivering real value through meaningful rewards.

That’s the focus of Loyalty and the Lost Art of Giving, a new eBook from Loylogic and The Loyalty People. It explores how smart brands are redefining success through emotional loyalty – and how modern redemption strategies are making the difference.

With more than 20 years of experience, Loylogic understands that what you offer in a rewards program matters. But how you make customers feel matters even more. This eBook shows why emotional loyalty is outperforming traditional models and highlights the brands leading the way.

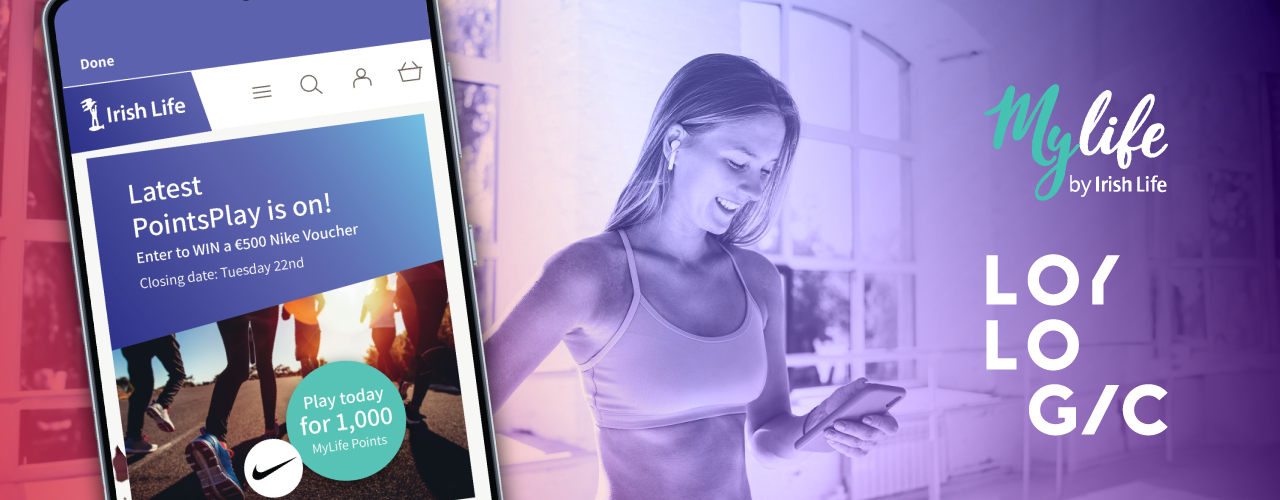

From travel and retail to charitable donations and curated lifestyle rewards, today’s loyalty programs offer choice, flexibility, and personal relevance. Featuring case studies from Etihad Guest, African Bank and Nescafé Dolce Gusto, the eBook reveals how loyalty can scale globally while still connecting locally.

Key takeaways include:

- Redemption is the defining moment. If members can’t find something meaningful to redeem their points for, loyalty loses impact.

- Flexibility drives return. A diverse mix of rewards empowers customers and keeps them engaged.

- One-size-fits-all is over. Scalable loyalty platforms must deliver local relevance.

- Ecosystems matter. Loyalty thrives when it’s embedded in a brand’s wider tech and customer strategy.

The eBook also explores how modern platforms like Loylogic make this approach scalable, seamless and profitable for organisations.

Whether you’re building a new program or refining an existing one, this is essential reading for any brand looking to move past transactions and build lasting loyalty.

To download a copy of Loyalty and the Lost Art of Giving, click here - https://www.loylogic.com/news/loylogic-ebook-aims-to-bring-back-the-art-of-giving-in-loyalty

-

African Bank’s Audacious Rewards named Loyalty Team of the Year at International Loyalty Awards

Loylogic is proud to congratulate our valued partner African Bank and its Audacious Rewards team on being named Loyalty Team of the Year at the 2025 International Loyalty Awards, held this week in Dubai.

This global recognition celebrates the passionate group behind Audacious Rewards, a fast-growing programme built on a bold mission to reward everyday banking behaviours and drive greater financial inclusion.

Audacious Rewards currently serves more than 1.4 million members and continues to stand out for its purpose-led innovation and impact. In the past year alone, the programme has launched a grocery benefit and a new Points-to-Investments feature, helping members earn value back on essentials and convert their rewards into savings.

Loylogic is honoured to support the African Bank team in delivering this pioneering programme. Special thanks go to Dr. Nceba Hene, Sbusiso Kumalo, Jessica Swart, Johannes Loubser, Mphathi Ndlela, Larona Suping, Moagabo Lekganyane, Moitheki Mashigo, Tshamano Tshinavhe, Nic Smit — and the many others driving this success.

This year’s award follows previous wins for Audacious Rewards, including Best Short-Term Initiative at the 2024 International Loyalty Awards and Best Relaunched Programme of the Year at the SA Loyalty Awards.

We are delighted to see the team’s continued achievements recognised on a global stage.

-

The Loylogic Podcast: Celebrating 20 Years of Loylogic — What’s Next?

Welcome to a special episode of the Loylogic Podcast, marking the start of our 20th anniversary celebrations in 2025!

But this isn’t a trip down memory lane. Instead, Founder and Chairman Dominic Hofer and CEO Gabi Kool look ahead — sharing what the next chapter of loyalty and reward marketplaces will look like in a future defined by dynamic, AI-driven, global-scale incentive solutions.

They dive deep into restoring the Lost Art of Giving — exploring how to bring emotional depth and strategic value back into loyalty programs, channel motivation, and employee incentives. It’s all about making rewards feel personal again, not just transactional.

In this episode, you’ll discover:

- Loylogic’s differentiated approach — and why the real job is to reward a brand’s best customers with memorable, meaningful experiences

- How to strike the right balance between personalization and scale in an era of automation

- Why trust and collaboration with merchants and brands is key to building sustainable partnerships

- How Loylogic continues to embrace technology and push boundaries through its marketplace of the future

- Fresh insights into the potential of dynamic, AI-powered reward catalogs to truly transform the loyalty experience

If you’re in loyalty, customer engagement, or just curious about what’s next, this conversation offers a fresh take on where the industry is heading — and why the most exciting part might just be still to come.

Listen now to find out more. A full transcript of this episode is available below.

01:41: Dominic, I know I said in the intro that we wouldn't be reminiscing, but for context, take us back to 2005.What was missing in the loyalty industry that inspired you to start Loylogic?

Dominic Hofer: "Well, you know, 2005 is a long time back. So imagine a time when people are flying around collecting a ton of miles, but don't really have lots of options to redeem them, like you would see today. So it was basically flights and upgrades. And, you know, I was myself, sort of a frequent flyer, flying around collecting these miles, and never felt you get to the rewards that you wanted. And wouldn't it be amazing if you can use your points and miles for anything else other than flight rewards, maybe also non-air rewards. And that's how the whole idea developed.

"We started to think about shops, e-commerce shops, where you can use your points and miles instead of cash. How amazing would that be? And that's really how it started.

"We then also discovered that building global reward shops comes with a little bit of a challenge. In fact, you know, we created a global marketplace before Amazon was global, or was even a marketplace. So we had to actually program and invent a lot of things to add merchants to our shops and offer their products globally, which is all part of the platform. And then we obviously also felt like you need to have an option to pay in a combination of miles in cash, because many users might not have the exact amount of points to pay for their desired product. Loylogic actually has two patents on the full flexibility of points plus cash payments. That's how it started."

03:36: Looking back, and as you say, 20 years is a long time, what's the one major way that you've seen loyalty change?

Dominic: "First of all, when we started, there were a lot of frequent flyer programs. Today, loyalty is growing, right? It goes into FMCG or CPG markets. Many online shops have a their own loyalty program. The engagement or loyalty initiatives are many fold, and it's just amazingly growing, because it's a super, super, powerful marketing concept, right? You are somehow leveraging your community that you have as a company, and you try to create business around that community in a nice way. You're not just selling emails and databases. You're actually creating value for the partners around it through the selling of points and miles, mostly.

"But then, you know, there's always a bit of innovation that comes into the industry. I would hope that Loylogic, as the recognized innovator in the space, that we were at the forefront of bringing these elements to market. You know, we invented the marketplace slider, we were first to have auctions, first to have raffles. We built Pointspay, of course. I think more and more this industry is going in the direction of how can you, at scale, connect loyalty currencies and loyalty communities with merchant networks? With retail, be it online, but of course, also in store, and I think that that is where we see a lot of changes, and we can create value for the industry."

05:09: Do you think that rewards have been commoditized as loyalty has grown, and that there's been this loss of emotional value?

Dominic: "Yeah, when we talk in particular about rewards. I think my observation is the following: when we started, you had, maybe at best, a paper catalog that was sent home, and then you could order something via phone as a reward and so on. And we've sort of brought, like a digital shop, where you could order your products online to the market. I think that was exciting. And how did we differentiate? We actually had many, many categories and 1,000s of products that you can select from, which is, of course, a lot more than what you can put into a paper catalog. You know, click and it will be shipped home, wherever you live.

"But I think you know that marketplaces today, there are other marketplaces, that basically offer gift cards, maybe not as many products as we would do, or the combination of redemption methods, but I think it has become a bit, how should I say...almost a bit boring!

"I find there's a lot of programs out there, that just offer something as a reward in a simple reward shop. And, you know, consumers, they get these points and miles for free, so they should be happy if they get something. But for a true loyalty program, you know, the reward is not the points and miles that we're giving. It is what the user gets for the points and miles, and the reward is the thank you for the loyalty that the best consumers of a brand are giving to this brand. So this moment needs to be an amazing and rewarding moment. You cannot do this in super-simplistic reward experiences that are sold at ideally zero cost in the market. I think that whole experience, and it starts from the order process to actual delivery at home, needs to be a magic moment, you know, that deepens or strengthens that glue between the best customers and the brand even more. I think that's where value can be created and differentiation can be created in the market. I think that's the exciting world of rewards today.”

07:36: Gabi, that leads us nicely onto a topic you've spoken about before, which is bringing back the art of giving in loyalty. Why do you think the industry has lost that touch?

Gabi Kool: "Yeah, I think it's a little bit building on the example that Dominic just gave, right. The example that we always love talking about when we are with potential new clients, or with existing clients, is the lazy friend analogy. Imagine you go to the birthday party of your best friend, who has just turned 50. You've known each other for ages, and you come to that party. You say: 'Look, John, we've known each other for such a long time. And I was thinking, what kind of gift can I give to you? One that reflects all these years that we spent together and how well we know each other, right? And then you bring out your gift and you give that person an Amazon gift card. It's a horrible, lazy friend example.

"In a certain way, in our daily working lives, we are entrusted to look after the best customers, or the most important customers, or new customers of our clients, to create a memorable moment. And so we need to understand what these communities are and how we can make that a moment when that company gives a certain gift to that important customer that cements that brand loyalty and that relationship that the company has with that particular brand. So we like to think of that example in there. And with the rise of course of APIs and millions of SKUs at your fingertips, the temptation is there for many companies, and we've seen that, to just offer more and more and more, but not thinking about what is a truly meaningful offering or catalog or gift for that particular customer segment to make sure it's memorable.

"So, yeah, we think that the art of giving has gotten a bit lost over time in the industry, and we put a lot of emphasis on bringing back that art of giving, Austin."

Dominic: "I think if I can just add here, I think it's also important, you know, to say that if someone shops for a reward, right it's very, very different from shopping for any other product, right? So I'm sitting at home and I need to buy a coffee machine. I probably think about, where do I get the biggest selection? And I go to Amazon, and then I check the best price and product and whatever, I never think of my points and miles on accounts, and how I'm going to earn a reward trip, even if I have shopped there before. It's just not top of mind. So all of this is triggered through communication, through the program, and then when a user actually dedicates time, it better be a good experience, and not in terms of, I can select from a million coffee machines, but really, you know, there is a great price. There could be an attractive other product that I didn't think about, and maybe that's great for my kids and so on. It needs to be engaging, and I need to feel like this company actually cares and really wants to reward me, and then I feel good, and I, you know, continue to be loyal to that brand."

10:42: So what's stopping brands from getting this right?

Gabi: "Like I mentioned, I think with the rise of the API in the marketplace, it has increased access for a lot of loyalty operators or brands, but it made the rewards almost too transactional. So you see a lot of maybe cookie cutter approaches with too little impact, too little imagination. And so I think that's where a big challenge lies for a lot of these kind of programs.

"And the other part that we also see why sometimes brands don't get this right, is what we call the funding challenge. A lot of brands or loyalty programs continue to treat loyalty economics almost through the prism of a sales promotion logic. So they don't necessarily think about relying on margin funded rewards through proper points liability practices. So if you give people points and you expect them to redeem at some point in time for an exciting kind of gift, you need to also make sure that kind of the back of the house is in order that you put sufficient funding aside for when these kind of redemptions take place. We've seen some programs falling victim of their own success, when programs gain in popularity and members get more and more engaged, that if you treat it as a sales promotion logic, it means that you give the points now, and you basically kind of take it, maybe partially your financial books right now, if you don't set the proper money aside funded from the margin that you make on that transaction at that point in time, you've got a risk that you might not have sufficient funding for these programs when the actual redemptions take place.

"So there's a lot of art in getting these financial budgeting elements done properly, and very often, we help to untangle this complexity, let's say, for our clients to make it understandable, make sure that they have got also that part in place."

Dominic: "It's a very dangerous path. You know, you're basically successful in your program, but you don't follow with the money that you put aside to fund the rewards, and then you're basically cutting the value proposition. And you enter from a high of a growing program, you enter very quickly in a downward spiral by not having the funds ready, and you're killing an actually amazingly successful initiatives. It's very dangerous, a very good point, I would say.

"What brands sometimes might do wrong is start a loyalty program and give out points. But again, the points are not the reward, so you need to think about, what do I want to give people you know, against the points? How do I create that experience? And this experience needs to be right from the beginning, because that's actually the reason why members might sign up with the program, or actually not. The value needs to be there, and it needs to be a combination of products that are practical but also aspirational, things that might not even transact, but it creates dreams in my head, and that's why I want to participate in that program. I think Amex Membership Rewards does this pretty well as a standard proposition of every Program is an attractive reward shop which also has rewards in there that are not easily transactable, right? But they instill dreams and aspiration in users, and that's the reason why they want to participate in a program and use the credit card.

"As Gabi said, just offer an Amazon gift card and then you buy whatever you want. That's the same as cashback, and you give all the loyalty and all the brand loyalty over to Amazon. And that's not a good approach."

14:16: That's a nice pathway into the future of incentive marketplaces. Loylogic has always focused on being at the forefront of loyalty and driving innovation. So what's next for the future of rewards? What's going to maintain that loyalty and connection between brands and their best customers?

Gabi: "If you think about the marketplace of the future, right, of course we were the first to bring the incentive marketplace to the industry 20 years ago. And of course, we love to talk also about where we see this going in the next 20 years. Of course, with millions of products and brands and merchants at our fingertips in our ecosystem, AI is playing, and is going to play an increasingly important role.

"One example is making sure you curate from these millions of SKUs the right dynamic catalogs for the community or this particular program, and building your own ecosystem around that. So, we're investing a ton of effort and excitement in that particular space. AI will play a massive role in helping to create dynamic, high performing catalogs, but AI, of course, is not this standalone element. It needs to still be linked to the right kind of problems and curation and oversight of our own experts in the organization. AI helps with that part, but we continuously adjust that part to make these ever-evolving dynamic catalogs, but the curation and human oversight remain a very vital element in there.

"In the end, we think that the marketplace of future goes in that direction. We've got a ton of initiatives happening in that space. In the end, the objective doesn't change. It still comes down to, how do we make our clients' best customers feel honored, rewarded and truly kind of recognized in an exclusive manner. But yeah, clearly, AI is a massive force for the good here in taking that to a whole another level."

16:20: Dominic, if I can bring you in here.

Dominic: "So I think being able to access a lot of SKUs in the back is important, and then, as Gabi describes, using the latest technology to bring that in an effective way in front of the eyes of a consumer that, again, is not coming to that place because they look for a specific product. They're coming to the place because they were triggered through something, and now want to reward themselves, so they don't have time to browse through a million products. It needs to go fast, and it needs to be exciting and so on.

"Tech helps, but of course, you need to have access to the right and best products in the back. I think where value will be created in the future is not large catalogs and billions of categories. It is really more like, how can you effectively connect a brand and a brand story to a specific community through these reward shops? So these reward shops become media outlets that create these bonds. I think that's that's the super exciting part, which completely plays into that thinking that we described of rewarding someone, rewarding with special products, special packages, special pricing, special stories and interaction with the brand, which further inhales value into the loyalty currency that the brand is actually giving to their best consumers.

"I think these two combinations tech and bringing brands together with these communities is the exciting part."

17:51: So Gabi, if I can bring you back in here, it seems from what you're saying, that the future isn't just about endless choice. It's about getting the perfect reward at the right time, through that dynamic catalog, through those constant adjustments that deliver exactly what's needed at the right time. Is this where AI will really come into play?

Gabi: "Yeah, but to my point earlier, AI doesn't replace the kind of the curation or the human element in there, because I think one of the things that we pride ourselves on a lot is that over the last two decades, we build very deep relationship with the merchants and the brands that we work with around the world. We've worked with them for over two decades, and to be true and reliable partners to each other is very important. So it's a balance between, how do we get brands and merchants and their content in front of the right communities. AI is a big enabler for us in that process, but there's so many criteria that goes into the curation. On one hand, we need to make the currencies and the programs extremely successful for members. Our other part of our job is also to work deeply with the brands and merchants so that they can bring their latest products, their latest content, their latest exciting stories, in front of the right community.

"You heard Dominic talk about loyalty as a media type an example in there. AI plays a big role in there, but it's only a part of the story. It's not the full story, clearly."

19:20: Dominic, I guess, tied to this is another buzzword that we hear and read about all the time, which is gamification. So how does gamification fit with everything else we've heard today, as loyal logic strives to engage and reward the best customers?

Dominic: "You know, I think gamification is not necessarily related to rewards. You have two types of rewards. That's funded rewards, so I can buy something with points and can pay fully with it, or in non-funded programs where you basically work with a marketing budget. Then, you know, you have coupons, or you have concepts like raffles. They might look like a gamification element to some people, but the kind of reward I find is not really the gamification element. I think it's the journey.

"Understanding where you would like to move the behavior of a consumer through your program, through your app, through your brand, the full experience, and then build little surprises and the bigger prize at the end of it, into that journey. So I think it's the journey and the combination of free and paid rewards, restimulates short-term adoption of something, and the long-term rewards, the paid reward states let a consumer stick to the brand or the app, mid- to long-term, and combination of these elements, that bring this together. I find this gamification. I think there's many different views. I think it's always very specific to the exact goals that the brand has and and then, you know, needs a bit of creativity on how you answer to that. It's basically the definition of campaigns."

20:58: Okay, so that comes back to Gabi's point earlier, that too many people are going down the cookie cutter approach to loyalty, where instead you need to be creating bespoke programs that are right for your customers and your communities. Do you think that's fair?

Dominic: "For me, absolutely."

Gabi: "Yeah, it is."

21:13: Excellent. So 2025, marks, 20 years of loyal logic. What are you most proud of so far, and what's next on the journey.

Dominic: "We're a Swiss company. We started in a very small market, and from day one we knew that we'll have to go outside massively in order to win business, and we need to be different. So I think what our team has done super well is come up with innovation. Some things work super well. Some things did not work well. So there's constant learning. But you know that drive is completely there and part of our DNA. We have clients from Japan to Latin America, Brazil, Argentina to South Africa to Iceland, of course, in the Middle East. And I think just going out there and conquering these very different cultures and so on, trying to understand this and respond to their needs with solutions, not only once, but reselling these contracts and growing it, is amazing work and part of our DNA, and I'm personally absolutely the most proud of that."

22:34: Gabi, the same question to you.

Gabi:"I'm equally proud of working with our talented team. They're fun, they're smart and they're intellectually curious, which is very important in our job, right? Because one part is going to the different countries, but then we also work across all kind of different verticals. So you have to think about, how can we help this particular brand build the most admired coffee community in the world? And then the next day, you have to deal with an airline who wants to build out their frequent flyer program. Or then, basically, we got a new client with high performing athletes in Switzerland. They're building a very interesting proposition. So I think that our team is there to be curious, to help our clients and want our clients to succeed? And, of course, for us, that's an amazing journey to be a part of.

"The other part that I'm very proud of is that we've been operating for 20 years in the consumer loyalty space, but now we're also entering the motivational industry. So how we can help behavioral changes for employees and channel management in there via our new solution, Ultimate? I'm super proud that we're venturing into the next territory for us as a company, where we can leverage our existing technology and our global content, but with a slightly different twist. So I'm very curious to see how we're going to fare. I'm very proud of our adventurous spirit to continue pushing forward."

24:21: So to wrap up, do you have one final message to the industry that really sums up how you see loyalty going? So Dominic, let's go to you first.

Dominic: "Our job as suppliers to the industry is to make sure that the best consumers of a brand love their brand more, and I think that's why you build a loyalty program, to give back. So let's do that again with exciting concepts, so people really feel excited about it. That would be my message."

24:56: And Gabi, final word to you.

Gabi: "I think my final message to the industry is, the future of rewards isn't about offering everything. It's about offering the right thing at the right time in a way that makes customers truly feel valued. It's our job to really look after our clients' best customers and to avoid at all costs that these programs are seen as the lazy friend. We want to make them shine, shine, shine!"

-

Loylogic and Tamra Chandler Partner To Launch the First Science-Based Global Employee Motivation Platform

Loylogic has partnered with celebrated thought leader M. Tamra Chandler to introduce a groundbreaking approach to employee recognition: The 100 Moments That Matter – exclusively designed for Ultimate.

Tamra has devoted her life's work to elevating human and team performance through practices that put people first, and The 100 Moments That Matter is a unique and powerful platform for achieving these goals.

For the first time, organizations worldwide will have access to a curated, science-backed framework for employee motivation, integrated directly into Ultimate, Loylogic’s Points as a Service (PaaS) platform. This innovative framework ensures that HR teams can recognize employees in the right way, at the right time, and for the right reasons, without the complexity of managing vendors, currencies, or logistics across multiple markets.

A first-of-its-kind framework for employee motivation

Tamra Chandler has redefined how organizations drive engagement, performance, and workplace culture. Drawing from her decades of research, consulting, and thought leadership, she has now created the first-ever curated list of 100 Moments That Matter – a framework that identifies the key recognition moments proven to drive employee engagement and retention.

This exclusive framework has been developed specifically for Ultimate, making it the only rewards platform with which companies can seamlessly embed a research-backed recognition strategy into their employee motivation programs.

Unlike generic recognition programs that focus solely on tenure or performance-based bonuses, The 100 Moments That Matter provides a structured yet flexible approach that HR teams can use to inspire their people with meaningful, personalized rewards.

Ultimate: removing complexity, maximizing impact

Global companies often struggle to maintain consistent, impactful employee recognition programs across different regions, facing challenges such as multiple suppliers, fragmented platforms, and operational inefficiencies. Ultimate solves this by offering:

- A single, seamless platform for all employee rewards globally

- Ultimate Stars – a global rewards currency that employees can redeem for experiences, merchandise, travel, gift cards, and more via Loylogic’s award-winning marketplace

- Automated, AI-driven recommendations that match recognition moments with meaningful rewards

- Seamless integration into HR systems, eliminating manual processes and multiple vendorsA data-driven approach to employee engagement

By integrating Tamra’s exclusive The 100 Moments That Matter framework, Ultimate ensures that recognition isn’t an afterthought, but rather a strategic tool that creates thriving cultures and delivers differentiated business performance.

This unique collection of moments focuses on recognizing and rewarding meaningful actions and behaviors that contribute to an exceptional and inspiring workplace culture, driving employee connections and organizational success.

Each of the 100 Moments That Matter is grouped into 25 themes, such as:

- Nice Job!: Recognizing exceptional performance, such as consistently delivering high-quality work or meeting deadlines under difficult circumstances.

- The Best of Us: Rewarding collaboration and resilience, like mediating between colleagues to resolve an issue or leading by example during challenging times.

- Delighting Customers: Celebrating customer-centric behaviors, including exceeding customer expectations through service or solving long-standing customer issues.

- Helping Them Grow: Supporting team development by intentionally transferring skills and know-how to others or coaching and mentoring team members to succeed.

- Innovation: Encouraging creative thinking, such as proposing new and novel ways of working or exploring possibilities while constructively challenging the status quo.These moments prompt employees to think beyond familiar recognition themes while creating a structured, scalable approach to appreciation.

"Companies today recognize that engaged employees drive success, but traditional reward programs are often reactive, transactional, and disconnected from what truly motivates people," said Gabi Kool, CEO of Loylogic.

"With the launch of The 100 Moments That Matter exclusively within Ultimate, we are providing HR teams with the first-ever framework that combines behavioral science, AI-driven automation, and frictionless global rewards all in one solution. This is not just about offering rewards; it’s about ensuring they create real impact."

So how does Ultimate go beyond just providing rewards? By ensuring that recognition becomes a meaningful aspect of the culture, and that it flows with the rhythm of work. . Further, Ultimate helps your employees take notice of the contributions of others and say, “I see you and the positive impact you have on our team.”

Key capabilities include:

- AI-driven recommendations that suggest relevant moments for recognition

- Global scalability, making it easy for companies to maintain a unified rewards strategy across all locationsLooking forward, Ultimate peer-to-peer recognition will also be developed, enabling employees to reward each other instantly to further improve motivation and drive team-based recognition.

Transforming employee motivation for the future

According to the 2025 US Appreciation Index Report, employees who feel valued at work are significantly more engaged, productive, and likely to stay with their organization. However, many businesses lack a structured approach to recognition, leading to inconsistency and missed opportunities to build loyalty.

"By creating The 100 Moments That Matter specifically for Ultimate, we are giving companies a pathway to a recognition culture that is not only meaningful but also effortless to implement at scale," said Tamra Chandler.

"I’m thrilled to partner with Loylogic and their Ultimate PaaS solution to redefine workplace recognition. This is the future of employee motivation: one that is rooted in science, powered by technology, and designed for real human connection."

Tamra will share more insights on the partnership at the HR World Summit in Lisbon this May, where she will present the framework alongside Loylogic leadership. We have a limited number of exclusive tickets available. Register your interest now and be part of the conversation shaping the future of workplace recognition.

Companies looking to transform their approach to employee engagement and create a truly strategic rewards program can learn more by visiting Ultimate.one and booking a demo today.

A little bit about M. Tamra Chandler

Tamra Chandler is a globally recognized thought leader, speaker, and author who has devoted her career to elevating human and organizational performance through people-first practices. With over three decades of experience in business transformation, she has revolutionized how organizations approach performance management, feedback, and employee recognition.

Named one of Consulting Magazine's "Top 25 Consultants" in both 2007 and 2014, Tamra founded PeopleFirm LLC in 2009, leading it to recognition by Forbes as one of "America's Best Management Consulting Firms." She is known for her groundbreaking books "How Performance Management is Killing Performance" and "Feedback (and Other Dirty Words)," as well as creating the innovative "100 Moments That Matter" framework—a research-backed approach to meaningful employee recognition.

Through her down-to-earth style and results-driven approach, Tamra helps organizations discover the sweet spot where inspired people and inspired performance intersect. Her work demonstrates that when companies create environments fostering genuine human connection, meaningful feedback, and purposeful recognition, extraordinary results naturally follow. From nonprofits to multinational corporations, her transformative approaches continue to shape how forward-thinking organizations build cultures where both people and performance thrive.

-

The Loylogic Podcast: Redefining Employee Recognition Through 100 Moments That Matter

Recognition is more than a thank you. It is the foundation of a thriving workplace, driving motivation, engagement, and performance.

In this episode of Rewarding Conversations, we explore how Ultimate, Loylogic’s Points as a Service (PaaS) platform, is combining a science-backed employee recognition framework with seamless technology to help businesses make appreciation effortless, structured and truly meaningful.

Gabi Kool, Chief Executive of Loylogic, and celebrated thought leader and renowned workplace culture expert Tamra Chandler reveal how an exclusive 100 Moments That Matter framework provides a science-backed way to transform how organizations recognize and reward their people. They discuss why traditional recognition programs often fall short, how companies can move beyond transactional rewards, and what it takes to build a culture where appreciation becomes a habit.

If you are an HR leader, a business executive, or someone passionate about workplace culture, this conversation will give you fresh perspectives and practical strategies for redefining employee motivation.

Listen now to discover how recognition can drive engagement, retention, and high performance without the usual complexities of managing multiple reward platforms and vendors.

Tamra will share more insights on the partnership at the HR World Summit in Lisbon this May, where she will present the framework alongside Loylogic leadership. We have a limited number of exclusive tickets available. Register your interest now and be part of the conversation shaping the future of workplace recognition.

Companies looking to transform their approach to employee engagement and create a truly strategic rewards program can learn more by visiting Ultimate.one and booking a demo today.

Podcast Transcript:

01:56: What's the background to this partnership?

Gabi Kool: "Yes, happy to kick this one off. Basically, I had the pleasure of meeting Tamra. I think it was last year in Switzerland. We were both at an HR conference at the time, and I really, really enjoyed listening to her while she was speaking on stage about many things related to employee motivation, how to build high performing workplaces.

"While I was listening to that, I thought, what a perfect fit that would be for what we were at that stage, in the early stage of building with our Ultimate solution. So, I thought I would see if I could tempt her to be our global brand ambassador for Ultimate, and also to bring her thought leadership as a way of solidifying the science in our platform. So, I tried my luck, introduced myself and explained what Ultimate was about. And so that was how kind of our first interactions started. And here we are."

Tamra Chandler: "I would say it wasn't that hard of a sell, Gabi, because, you know, my passion is about creating workplace environments where people just really thrive and can show up and be themselves. That means having a workplace where gratitude and recognition are just how we do things around here. And, you know, anytime we can provide tools or assets that make that easier, it just fuels that kind of environment. Ultimate, to me, was like a no brainer. It just, it removes so many of the barriers, and it creates that platform to deliver a healthy and inclusive and warm environment."

03:43: That's the perfect segue into the first question for you, Tamra, focusing in on your specialist area. Why do you think organizations often struggle with creating meaningful employee recognition?

Tamra: "Yeah, that's probably one of the bigger questions, right? And I think we have to kind of step back and say, well, what are we trying to do? And we're trying to create a new habit. Recognition needs to become a habit, and that habit needs to start with the individuals that make up the organization. They need to start to adopt a way of shifting the organization culture, to accept this is, again, the way we do things around here.

"I often like to think about it as mindset, methods and muscle. And we always say you have to start with mindset. You have to sort of check in with, do we have a belief that recognition is a good thing? Do we understand the value and the impact that a culture that swims in gratitude and appreciation provides? Do we even understand some of the fundamentals, like when we talk about frequent recognition? I mean, that's an important question, because when you look at the science behind it, you'll see that there's this interesting gap. It's a paradox of some sorts between how frequently we want to be appreciated or recognized and how frequently we engage in offering recognition and appreciation. There's a Delta there. With mindsets, we have to start by aligning on why this is important, and what it would look like, and why it's important for us to have it in the culture.

"Once we've shifted our mindset to wrap around that concept, then we can start to think about methods and muscle and, you know, Ultimate provides us with this fabulous method. It gives us this platform to start to ease into that habit, to make it easy, to start to create this recognition culture, and then we go from there.

"Now, when we talk about muscle, if you ever look at any of my content, you'll see I always talk about leaders go first. And I think what's so important here is that once we've shifted the mindset, we've created the methods we need leaders to lead the way. We need them to start to engage in a way that says this is how we work here. This is how we operate, and this is the way that we recognize and celebrate the work that everyone brings each and every day."

06:12: And is that the inspiration behind the 100 moments that matter framework?

Tamra: "Yeah, I think when we started talking about the 100 moments, what I really wanted to do is bring to the table information, you know, the helpful information that provides the platform for high performing teams and inspired people. So how do you do that? I really leaned into what I know through the science. What do I know through my 30 plus years working with organizations to create inspired organizations to inspire people? But the aim was not just to provide this pick list for people, which is somewhat what it is, but to help us think beyond the common ideas, to help us really kind of broaden the topics that we might, you know, recognize or notice that are being offered within the organization that we see people doing every day.

"I think we fall into old habits of recognizing the same. Oh, you did a great customer presentation, or you did this, but there's so much more goodness that happens in an organization, and I think we need to broaden our horizons. So, the 100 moments was about how do we do that? How do we help people think more broadly about all the good things they're seeing and witnessing when they show up for work every day, or they dial into work every day, or, you know, however they're engaging?"

07:33: That, again, leads on to an obvious next question, which is how does this framework align with modern workforce trends such as the demand for more personalized and meaningful recognition, and also, how does it tie into the kind of modern ways of working, hybrid work and remote working, etc?

Tamra: "What's interesting about that question is sort of asking yourself, what has changed? Humans haven't changed, but their expectations have changed when they're engaging in a workplace.

"What I mean by that is, if you look at human motivation, we have craved being part of something, this idea of wanting to be included in a tribe, of being appreciated by our tribe that's as old as the human race. But for years in the business world, we really tried to separate the human side of the workplace from the more business side of the workplace. We tried to draw a line, if you will, between the head and the heart. So, I think what has changed again is that, thankfully, we're more enlightened. Now most of us have a greater understanding that separating the head and the heart is a fallacy. We can't really separate it, and that if we fail to really see to the human side of people, we diminish them, we put them in a sub-optimal state. They might be operating from a place of fear or just indifference, right?

"When you look at some of the engagement scores, with our more enlightened state, as we're leading organizations and people, we need to understand the importance of helping people know that we see them. That we see the value that they're bringing, that we are attending to their heart and their head. And that begs us to start to create these environments where we can celebrate and recognize people that we can lean into practices that say thank you and recognize them for the contributions. And when we do that, amazing things happen. We put people in that optimal state where they're showing up as their whole self, where they're energized and excited about the work. And those types of things create this whole energy and performance, and amazing things really happen.

"Back to your original question, Austin, but the 100 moments provides us this framework. It gives us these science backed prompts that help us to be better at noticing that goodness and seeing to the whole person, and making them feel included, that you’re important, you're part of the tribe. That is some powerful stuff."

10:06: Indeed, extremely powerful. I think everybody would agree with that. So, Gabi, bringing you in here, and given everything Tamra has mentioned there, how does Ultimate address the common challenges companies face, and how do you kind of go about creating an effective global recognition program?

Gabi: "When we were looking around to develop Ultimate and we were talking to HR leaders and kind of building our own hypothesis of what was kind of mostly needed in that space, one of the observations that we had at the time, Austin, was that you will find great, great HR leaders out there, of course, in many, many kinds of companies, and also great leaders in organizations who want to do the right thing. But if you looked at what the HR departments often had to do when it came to incentive programs, especially multinational organizations, it was very often that a lot of the energy that they had to spend on it was more going to the operational part, finding the right kind of tech partnering country, A, B, C, D, E, the right kind of incentive partner in the in these kind of countries as well. The space where the HR leaders that we spoke to really wanted to spend their time was building that kind of right designs and programs where, to Tamra's point about the head and the heart, they were rewarding the micro moments.

"When we set out to develop Ultimate, we wanted to take care of that by building a platform that takes, especially for multinational organizations, that operational burden away, so that we can enable, via our platform, the right kind of design elements for the right program for your organization, as an HR leader.

"We've made a lot of really great progress so that it's now very simple for an HR leader to just buy the relevant number of motivational currencies via the platform to then distribute it in the manner that best suits, without having to worry about the operational elements."

12:27: So, Tamra, coming back to the 100 moments that matter, could you share a few examples for us, please?

Tamra: "We've designed the 100 moments to really think about what are these different sort of practices that we could have, or sort of themes. You're going to see things that are typical, like, you know, nice job is one of our themes. A moment under that is achieving a notable impact of performance. That's pretty common, but we tried to go well beyond that. So, another of our categories is called the Best of Us. And one of my favorites there is operating without judgment or blame. And I know in my best days, I do that, but you know, we don't always achieve that every day.

"Resilience, owning it, really thriving an environment of uncertainty, is another one I really like, right, called I'll be There. And one of the moments is generously giving your time to support others. You know those colleagues who lean in when you need that help and wanting to say thank you and recognize that we have inclusion as one of our categories. And one of my favorites in that is creating opportunities for others to shine.

"Our category of Authentically Human has some good ones, like displaying enthusiasm, passion and joy at work and just saying, thank you to those people that bring that energy. So those are just a few, Austin."

14:01: So how do moments like these help organizations kind of go beyond that transactional rewards culture toward kind of building a culture that that's full of engagement and loyalty?

Tamra: "Gabi spoke to this, as far as the micro moments go, is this idea of the personalization. We're really looking to make it easy to recognize those moments, to take a light pause, to say, I see you. I see this value you bring. This isn't a transaction. It's a personal reflection. There's a reason we call them moments, or even micro moments, right? Because that's what it is. It's a simple moment to pause, to do a little noticing, and to say, thank you."

14:51: That sums it up beautifully. And is it true that HR leaders have, often, not in all cases, but often have struggled to get buy in from leadership when it comes to investing in recognition? And does this new framework, this science backed framework, help in changing the discussion around the investment?

Tamra: "Well, I certainly hope it does. Sadly, sometimes it's hard to get support for this, even though, you know, there's a very strong business case. If you look at the science behind recognition, you look at the benefits it brings, when people are frequently recognized, when they feel connected, they're engaged, and when you're engaged, you perform better. So, there's a lot of moments in here that are team-based because when our teams are engaged, and we're really kind of moving as a high performing team, that's when we really drive performance for an organization.

"So, there's a lot here from a business case, but sometimes you don't get leaders who really connect with those numbers, or necessarily believe those numbers, and that can make it difficult. But I think there's a couple of things happening here. I think Ultimate lowers some of the barriers, as Gabi's talked about, to ease into this. So that improves your business case, because it takes away some of the things that have made it hard in the past. And then, we're creating these moments that make it easy and light and not adding extra burden to managers or others. So, there's a lot of goodness that's happening here.

"My one little tip for leaders is, if you're having trouble with a with a business leader, sometimes what can be most powerful is to sit and talk with business leaders about their own history, and get them talking about the times that they were recognized and the impact that had on, their own experiences, or the impact that might have even had on their career. And I think if we if, sometimes, if the if the business case strategy doesn't work. Sometimes the heart strategy works and gets them really thinking about how this is important in creating those same types of experiences for the people in their own organization. It can be difficult, but I think you can come at it from both those ways, and Ultimate makes the business case easier, and we make it lighter for your managers, and we can really impact, you know, the experience for your people, for sure."

17:28: So, what you're saying there is that there's a very human, centered approach in your framework?

Tamra: "Yes, that is such a simple way to say it!"

17:42: Gabi, coming to you, how does Ultimate take that human centered approach and combine it with technology to create a platform that is truly transformational?

Gabi: It's an interesting one, right? We've now got these beautiful 100 moments built into a framework, and then the other part that you need to do in a platform like Ultimate is make it very easy for the HR director to bring this alive in an organization and administrate. But also, as we know, there's an enormous power in the whole peer-to-peer recognition area of these kind of incentives, especially if I can give, as an employee very easily, some Stars as a form of recognition for somebody in my team or my organization who has done something good for the company or good for me or basically helped me out.

"Now, how do you enable that part? It's not so easy if you've got a team of 5,000 employees to educate everybody about the 100 moments and exactly which moments to use, and when. So, where technology then comes into play, and that's what we're working out and rolling out as we speak, is, how can you then bring an AI component, for example, where somebody can describe what somebody did for them, and then in the back end of our platform, it automatically marries that to the right moment from the framework. So, when an HR director looks at kind of how the organization is recognizing and rewarding each other for the moment in there, are there certain blind spots, let's say, in the organization of behaviors that you would like to stimulate but that are never somehow either acknowledged or maybe displayed, can also be the case.

"So, we see a role for AI in there to make that rewarding mechanism easy for employees. We've also seen it in our own organization. Before we had built Ultimate, we had our own 'thank yous', where people could, on our internal platform, thank each other for certain activities. Everybody had their own mini budget of points that they could give away to their colleagues on a monthly basis. And we've seen, therefore, the power of that part now, where the technology comes into play, that's kind of, I think, where we make that as frictionless, and as easy as possible, so that there's no complicated steps in the way of enabling that.

"The other part, of course, is embedding this in the existing HRMS platforms that organizations are using. The more we can embed Ultimate in all the leading HRMS platforms, of course, that also makes it much easier for organizations to adopt it?"

20:43: I want to pick up on something you've mentioned there, which is around the whole rewards and incentive side of things. So how does Loylogic's expertise developed over more than two decades of creating rewards and incentive solutions position Ultimate to serve companies of all industries and sizes globally?

Gabi: "Yes, it's an interesting question, because our history lies very firmly in the consumer loyalty space. So we've been around for two decades, as you mentioned, supporting the largest either frequent flyer programs in the travel industry, largest bank loyalty programs with some of the most notable brands in the world there, as well as fast moving consumer goods or the CPG kind of brands with their loyalty initiatives, but it was always basically consumer loyalty, where our main job as a company was to support our clients, so these program owners could look after their best customers. So, when these companies want to reward their best customers, it was our job to get the right incentive at the right time, in the right kind of user experience, in the hands of their most precious asset, their customers, so that it positively influences the behavior of those customers via very memorable experience, and make these customers feel warm in their heart.

"Now, if you translate that to the employee motivation space, where we are newly entering with our solution of Ultimate, we're not dealing with an organization's best customers, but arguably with their other most important asset, their employees, their human capital. So also here, there's a very strong parallel with giving the right incentives to the people at the right time in a way that's fun, and how they can also recognize and incentivize their colleagues, so that it cements that relationship between the organization and the employee. So, while there's a slightly different angle to it, there's a lot of learnings that we take from our two decades of working on the business to consumer loyalty side into this B to E, employee motivational side.

"If you then combine it with, of course, the fact we have global technology, we have global content available for these kinds of programs that we support, we really thought, how can we then enable that to be a force to reckon with, to help these organizations around the world?"

23:21 Bringing everything together, what do you hope to achieve with Ultimate? What vision do you have regarding Ultimate's role in shaping the global motivation rewards industry?

Gabi: "Well, we're ambitious people Austin, so we've got high hopes! Basically, we would love to be THE global rewards currency in the employee or motivational space. And basically, that means that when these employees get recognized by their peers or by their managers or by the organization, they get something that they really love, rather than a well-meant incentive that might not be spot on for an employee. We think that giving them these Ultimate stars and then having a global reward shop with different kind of content for every market in that platform, and it doesn't matter if it's merchandise or gift cards or travel or experiences or like, with like the sky is the limit in there, is exciting. So, we that's what we are hoping for, dreaming of, and basically working really hard for to make our steps in that journey."

24:26: Tamra, similar question to you. What excites you most about the potential of the 100 moments that matter to transform workplace cultures and motivation?

Tamra: "I started off talking about my passion for creating those kinds of workplaces. And what I'm so hoping is that the 100 moments help people realize how often they see these good things happening around them. You know, in my feedback book, we talk about the fine art of noticing, and it is an art we're not very good at it. And. So I'm hoping that the people read these 100 moments and they're like, wow, you know, I never thought about that goodness. I see that happening over here or over there, but I'm going to start recognizing it now, right? I hope it inspires them to think about what really matters and how they can be part of an environment where people feel included, seen, appreciated, that it becomes this powerful way of celebrating so much that happens that we just sort of let go by us. But instead of letting it go by, we start noticing it and taking that moment to recognize it."

25:38: Indeed, it's a fascinating, kind of almost melting pot, isn't it, of art science, AI technology, the human centered approach, that that could be really impactful and have that enduring impact on employee engagement, I guess so. My final question to both of you is, what message would you like to leave for companies and HR teams seeking to elevate their approach to employee motivation and recognition?

Tamra: "I'm really wanting to help organizations build a true culture of recognition. And you know what I mean by that is that is the way we work. You know that's what culture means. This is how we do things around here. And what I think is so powerful about what we're bringing to the market, between the platform and the framework and the 100 moments, is we're making it easy to create that foundation for that recognition culture.

"To me, recognition culture goes beyond the Ultimate 100 moments. It goes into the shout outs in a meeting, the pauses during a day to verbally recognize somebody. But I think what's so important about it is it truly becomes that platform that can fuel that culture, where we learn those new habits, where we start to create that energy that just sort of builds over time. And the Ultimate platform that's easy to implement, that's easy to deploy, that gets us thinking more broadly, brings that to the market. It's a powerful place to start."

27:18 And Gabi?

Gabi: "We all spend so much time at our workplace, right? So, my big hope for this whole joint initiative is that HR leaders are truly inspired by these moments.

"When we looked at the list of 100 moments, and we'd like to think that we are, of course, recognizing our team well, and that we are actively doing all the right stuff, day in, day out, I can tell you, when we looked at the list, there were at least 60 moments where I thought, yes, that's a great thing, I should recognize it more. I should be more mindful of paying attention to that and recognizing our team. The same feeling was felt in our own leadership team. I think you can take a lot of inspiration from that platform.

"I would really encourage all the listeners to this podcast go and explore the platform that we've put together with Ultimate and look at all these moments and reflect on them. And then, of course, we would love to hear the feedback from HR leaders around the globe while we're on this journey to further build out this platform. They are part of that journey with us. In the end, if we can help a lot of HR leaders in their own journeys it would be great. That's my hope and the ambition and what I believe we can achieve."

-

The Loylogic Podcast: Redefining Employee Recognition Through 100 Moments That Matter

Recognition is more than a thank you. It is the foundation of a thriving workplace, driving motivation, engagement, and performance.

In this episode of Rewarding Conversations, we explore how Ultimate, Loylogic’s Points as a Service (PaaS) platform, is combining a science-backed employee recognition framework with seamless technology to help businesses make appreciation effortless, structured and truly meaningful.

Gabi Kool, Chief Executive of Loylogic, and celebrated thought leader and renowned workplace culture expert Tamra Chandler reveal how an exclusive 100 Moments That Matter framework provides a science-backed way to transform how organizations recognize and reward their people. They discuss why traditional recognition programs often fall short, how companies can move beyond transactional rewards, and what it takes to build a culture where appreciation becomes a habit.

If you are an HR leader, a business executive, or someone passionate about workplace culture, this conversation will give you fresh perspectives and practical strategies for redefining employee motivation.

Listen now to discover how recognition can drive engagement, retention, and high performance without the usual complexities of managing multiple reward platforms and vendors.

Tamra will share more insights on the partnership at the HR World Summit in Lisbon this May, where she will present the framework alongside Loylogic leadership. We have a limited number of exclusive tickets available. Register your interest now and be part of the conversation shaping the future of workplace recognition.

Companies looking to transform their approach to employee engagement and create a truly strategic rewards program can learn more by visiting Ultimate.one and booking a demo today.

Podcast Transcript:

01:56: What's the background to this partnership?

Gabi Kool: "Yes, happy to kick this one off. Basically, I had the pleasure of meeting Tamra. I think it was last year in Switzerland. We were both at an HR conference at the time, and I really, really enjoyed listening to her while she was speaking on stage about many things related to employee motivation, how to build high performing workplaces.

"While I was listening to that, I thought, what a perfect fit that would be for what we were at that stage, in the early stage of building with our Ultimate solution. So, I thought I would see if I could tempt her to be our global brand ambassador for Ultimate, and also to bring her thought leadership as a way of solidifying the science in our platform. So, I tried my luck, introduced myself and explained what Ultimate was about. And so that was how kind of our first interactions started. And here we are."

Tamra Chandler: "I would say it wasn't that hard of a sell, Gabi, because, you know, my passion is about creating workplace environments where people just really thrive and can show up and be themselves. That means having a workplace where gratitude and recognition are just how we do things around here. And, you know, anytime we can provide tools or assets that make that easier, it just fuels that kind of environment. Ultimate, to me, was like a no brainer. It just, it removes so many of the barriers, and it creates that platform to deliver a healthy and inclusive and warm environment."

03:43: That's the perfect segue into the first question for you, Tamra, focusing in on your specialist area. Why do you think organizations often struggle with creating meaningful employee recognition?

Tamra: "Yeah, that's probably one of the bigger questions, right? And I think we have to kind of step back and say, well, what are we trying to do? And we're trying to create a new habit. Recognition needs to become a habit, and that habit needs to start with the individuals that make up the organization. They need to start to adopt a way of shifting the organization culture, to accept this is, again, the way we do things around here.

"I often like to think about it as mindset, methods and muscle. And we always say you have to start with mindset. You have to sort of check in with, do we have a belief that recognition is a good thing? Do we understand the value and the impact that a culture that swims in gratitude and appreciation provides? Do we even understand some of the fundamentals, like when we talk about frequent recognition? I mean, that's an important question, because when you look at the science behind it, you'll see that there's this interesting gap. It's a paradox of some sorts between how frequently we want to be appreciated or recognized and how frequently we engage in offering recognition and appreciation. There's a Delta there. With mindsets, we have to start by aligning on why this is important, and what it would look like, and why it's important for us to have it in the culture.

"Once we've shifted our mindset to wrap around that concept, then we can start to think about methods and muscle and, you know, Ultimate provides us with this fabulous method. It gives us this platform to start to ease into that habit, to make it easy, to start to create this recognition culture, and then we go from there.

"Now, when we talk about muscle, if you ever look at any of my content, you'll see I always talk about leaders go first. And I think what's so important here is that once we've shifted the mindset, we've created the methods we need leaders to lead the way. We need them to start to engage in a way that says this is how we work here. This is how we operate, and this is the way that we recognize and celebrate the work that everyone brings each and every day."

06:12: And is that the inspiration behind the 100 moments that matter framework?

Tamra: "Yeah, I think when we started talking about the 100 moments, what I really wanted to do is bring to the table information, you know, the helpful information that provides the platform for high performing teams and inspired people. So how do you do that? I really leaned into what I know through the science. What do I know through my 30 plus years working with organizations to create inspired organizations to inspire people? But the aim was not just to provide this pick list for people, which is somewhat what it is, but to help us think beyond the common ideas, to help us really kind of broaden the topics that we might, you know, recognize or notice that are being offered within the organization that we see people doing every day.