In this episode of the Loylogic Podcast, Rob Clements, Lead Consultant at Loylogic, joins us to discuss how loyalty program owners can effectively measure and demonstrate loyalty program value, shifting thinking away from risk to opportunity.

In today's challenging economic environment, loyalty programs have become a crucial tool for businesses to engage customers, drive revenue and enhance customer lifetime value (CLV). However, loyalty program owners often face a significant challenge in managing program costs, particularly the cost of rewards, which is typically their largest expense and heavily scrutinized.

Rewards as an opportunity, not a risk

Rewards are viewed as a significant cost in loyalty programs, raising concerns among CFOs and CEOs who may be inclined to reduce budgets to save costs. However, Loylogic believes that this cost should be seen as an opportunity to showcase the value of the program in driving profitability and increasing CLV. Put another way, loyalty program owners can show how program rewards contribute to long-term business objectives, rather than being perceived solely as a financial burden.

Lowering cost per point and reducing program liability

By executing the right reward strategies, businesses can lower the average cost per point, reducing program liability. Program owners have an opportunity to optimize reward categories, identify cost-saving opportunities and enhance operational efficiencies, mitigating financial risks while maintaining the appeal and attractiveness of their loyalty programs. Loylogic uses actuarial science to get to the real picture of program liability, which avoids the financial risk or opportunity cost of inaccurate liability accounting. From this solid foundation further strategies are devised to smartly manage the cost per point and align directly with business objectives.

Driving profitable engagement through new redemption experiences

Loylogic, a leader in loyalty program rewards, drives profitable engagement by unlocking new and exciting redemption experiences for program participants. With their ability to source rewards globally, they have created a periodic table of program rewards. This enables them to offer a diverse range of options tailored to each loyalty program's unique needs. By expanding beyond traditional reward offerings, Loylogic enhances customer engagement, fostering stronger emotional connections. These unique redemption experiences, informed by behavioral science, not only drive customer satisfaction and loyalty but also attract new customers, increase their spending, and meet members' need for convenience, all while ensuring cost efficiency for program owners.

Optimizing programs for customer lifetime value (CLV)

At the heart of Loylogic's approach is a focus on maximizing customer lifetime value. By using the most suitable solutions, loyalty program owners and directors can analyze customer data, identify behavioral patterns and tailor rewards to optimize CLV. Loylogic's data-driven strategies ensure that every reward offered aligns with customers' preferences, driving long-term loyalty and fostering lasting relationships which capture future profits. By optimizing programs for CLV, businesses can achieve sustainable growth and proactively manage churn.

Find out more: The Loylogic Group Podcast

In the latest episode of the Loylogic Podcast - click below to listen - we discuss all of the topics discussed above and more. Chapters in the podcast include:

1. Managing risk and profitability (01:41 to 04:43)

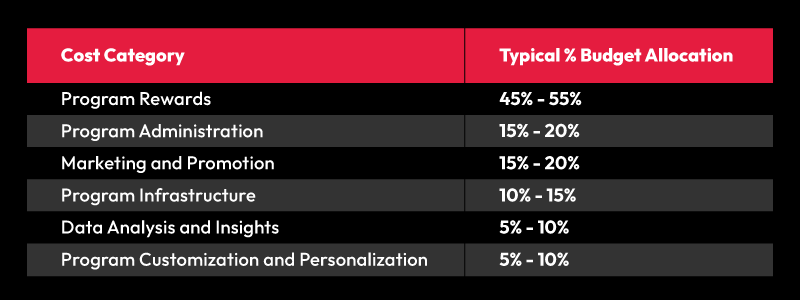

- The guiding principles that should we be using to establish a budget for rewards and how to strike a balance between incentivizing customers and maintaining a solid bottom line.

- As loyalty programs evolve and costs fluctuate, we look at how program owners can stay one step ahead and effectively anticipate these changes and safeguard against unexpected financial challenges.

2. Rewards, redemption and resource management (04:43 to 11:54)

- Redemption rates of loyalty points or miles can have a significant impact on a program's finances. How can program owners forecast these rates accurately and control them strategically? Can you share some insights on maintaining the equilibrium between customer satisfaction and business viability?"

- The liability associated with loyalty points and miles and how program owners can effectively manage this while ensuring that the program remains appealing to the customers.

- How various types of rewards might offer different levels of cost-effectiveness and strategies for allocating resources optimally across diverse reward types.

3. Metrics and program management (11:54 to 14:12)

- The key metrics or KPIs that program owners should focus on to effectively evaluate the financial performance of their loyalty program.

- How these metrics should be interpreted to make informed decisions about the program's future direction.

Enjoy listening!